Ethereum Price Prediction: Technical Breakout and Fundamental Catalysts Point Toward $5,400 Target

#ETH

- Technical Breakout Potential - ETH trading above key moving average with positive MACD momentum suggests upward trajectory toward $5,400 resistance

- Fundamental Catalysts - Pro-crypto regulatory environment and institutional adoption through ETFs provide long-term growth drivers despite recent outflows

- Risk Considerations - High leverage in current rallies and profit-taking near all-time highs warrant cautious position sizing and risk management

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

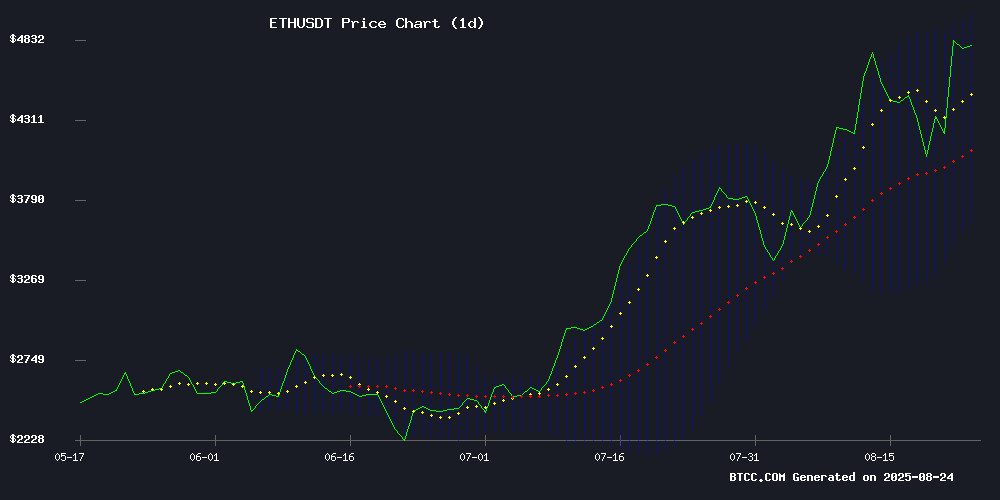

ETH is currently trading at $4,772.25, significantly above its 20-day moving average of $4,325.14, indicating strong bullish momentum. The MACD indicator shows improving conditions with a positive histogram reading of 10.86, suggesting potential upward movement continuation. Bollinger Bands position the current price NEAR the upper band at $5,002.01, which typically acts as resistance but could signal breakout potential if momentum sustains.

According to BTCC financial analyst Emma, 'The technical setup suggests ETH could test the $5,400 resistance level in the near term, with the moving average providing solid support around $4,325.'

Market Sentiment: Mixed Signals Amid High Volatility and Institutional Developments

Recent news highlights both opportunities and risks for Ethereum. Positive catalysts include Arthur Hayes' $20,000 price prediction driven by Trump's pro-crypto policies and Ethereum's transaction volume outperforming Mastercard. However, concerns emerge from Leveraged rally risks and the first ETF outflows in three months.

BTCC financial analyst Emma notes, 'While long-term fundamentals remain strong with institutional adoption and technological improvements, investors should be cautious of short-term volatility driven by excessive leverage and profit-taking near all-time highs.'

Factors Influencing ETH's Price

Ethereum Faces High-Risk Setup as Leverage-Driven Rallies Signal Volatility

Ethereum has breached its all-time high, surging to $4,886 before stalling below the psychological $5,000 threshold. The rally, fueled by derivatives leverage rather than organic spot demand, presents a precarious balance between bullish momentum and potential correction.

CryptoQuant data reveals six Leverage-Driven Pump signals this month alone—a pattern historically associated with volatile reversals or extended rallies before exhaustion. Institutional accumulation underpins long-term growth, but the derivatives market threatens near-term stability.

Analysts remain divided. Some anticipate continued price discovery, while others warn of profit-taking risks. The coming sessions will prove decisive as ethereum navigates this inflection point, with leverage unwinds likely determining whether $5,000 becomes support or resistance.

Ex Populus Sues Elon Musk's xAI Over Brand Dispute in Ethereum-Based Gaming Network

Ex Populus, the operator of an Ethereum-based gaming network, has initiated legal proceedings against Elon Musk's artificial intelligence venture, xAI. The lawsuit centers on an alleged brand infringement, marking a rare clash between crypto gaming and AI sectors.

The dispute highlights growing tensions as Web3 projects increasingly intersect with traditional tech domains. Ethereum's smart contract capabilities remain pivotal for gaming networks seeking decentralized solutions, even as high-profile legal battles emerge.

Ethereum Upper Realized Band Signals Market Heat: Profit-Taking Zone Ahead

Ethereum weathered a turbulent week, plunging below $4,200 before rebounding sharply to set a new all-time high at $4,886. The swift recovery underscores robust demand, with institutional accumulation and shrinking exchange reserves fueling the rally.

Analyst Darkfost notes ETH now tests its upper realized price band—a historical profit-taking zone. While this signals overheated conditions, it also reflects sustained bullish momentum as Ethereum ventures into uncharted territory.

Ethereum Price Breakout Sets Stage For Rally Toward $5,400 – Analyst

Ethereum (ETH) surged over 7% this week, buoyed by broader crypto market optimism tied to potential US rate cuts. The altcoin now hovers near $4,700 after facing resistance at $4,800. Technical analysis suggests a bull flag breakout, signaling buyer dominance and potential for further gains.

Market analyst Titan of Crypto highlights ETH's recent escape from a descending consolidation channel—a classic continuation pattern. The initial 41% rally from $3,400 to $4,800 in early August formed the flagpole, while the subsequent correction reflected typical consolidation. Trading volume dried up during this phase, indicating weak selling pressure rather than sustained bearish sentiment.

Arthur Hayes Forecasts Ethereum Rally to $20,000 Amid Trump's Pro-Crypto Policies

Arthur Hayes, former BitMEX CEO, predicts Ethereum could surge to $20,000 this market cycle, citing Donald Trump's pro-crypto legislation and institutional adoption as key catalysts. The projection follows Ethereum's recent all-time high of $4,880, which Hayes interprets as the starting gun for altseason.

"Once it's broken through, you have a massive gap of air to the upside," Hayes told Crypto Banter, referencing Ethereum's price potential post-breakout. The GENIUS Act, designed to regulate stablecoins and combat crypto fraud, has already prompted Treasury Department action with an August 18 Request for Comment on illicit activity mitigation.

Institutional interest compounds the bullish case, with Hayes noting the legislation creates necessary guardrails for traditional finance participation. The combination of regulatory clarity and Trump's advocacy could ignite what Hayes describes as "frenzy mode" for leading altcoins.

Ethereum Price Prediction: Onchain Data Hints at Path to $20K Amid Accelerating Accumulation

Ethereum holds steady at $4,760 after rallying from $4,100 lows, fueling speculation of a march toward $20,000. Technical patterns suggest bullish continuation, with a developing ABCD harmonic formation and bull flag consolidation below the $4,900 resistance level.

Momentum indicators paint a constructive picture—the RSI at 65 avoids overbought territory while MACD's widening histogram bars signal growing buying pressure. Higher lows in candlestick formations point to strategic accumulation rather than distribution.

Traders eye $5,300-$5,700 as next targets should ETH breach current resistance. The market appears to be positioning for what could become Ethereum's most aggressive price discovery phase since its 2021 bull run.

Ethereum ETFs See First Weekly Outflows in Three Months Amid Market Volatility

Investors withdrew $241 million from Ethereum ETFs during the week of August 22, marking the first net outflow after three months of sustained inflows. Early-week redemptions peaked at $429 million on Tuesday—the second-largest daily outflow since launch—as inflation concerns rattled markets. A late-week rally driven by dovish Fed commentary softened the blow, with $625.3 million flowing back into the products on Thursday and Friday.

The reversal tracked Ethereum's price action, which slumped on macroeconomic fears before rebounding to fresh highs. While the outflows signal short-term caution, Ethereum ETFs continue demonstrating stronger resilience compared to other crypto investment vehicles. Market participants now watch whether this proves a temporary setback or the start of a broader rotation.

Ethereum Outperforms Mastercard in Transaction Volume, Market Cap

Ethereum ($ETH) has eclipsed Mastercard in both market capitalization and transaction volume, marking a pivotal moment for cryptocurrency adoption. With a market cap of $568.06 billion, Ethereum now surpasses Mastercard's $541.46 billion valuation. The altcoin recently hit an all-time high of $4,870, trading at $4,718.35—a 9.59% surge in 24 hours.

Institutional interest and bullish sentiment fueled by the U.S. Fed's暗示 of potential rate cuts have propelled Ethereum's ascent. The network's scalability and utility are increasingly validated by its ability to outpace traditional financial giants.

Ethereum Price Breaks All-Time High — Analyst Sets $7,000 As Next Target

Ethereum surged 14% on August 22, reclaiming its 2021 all-time high of $4,878 after Federal Reserve Chairman Jerome Powell's remarks ignited bullish sentiment across crypto markets. The second-largest cryptocurrency now faces a critical juncture: either consolidate below record levels or enter a new phase of accumulation.

Alphractal CEO Joao Wedson predicts algorithmic trading clusters could drive ETH toward $7,000-$7,500 if resistance breaks. Market makers appear positioned to absorb liquidity and suppress volatility—a classic setup for major capital inflows during cycle shifts. The rally underscores Ethereum's continued dominance among top-tier digital assets.

Vitalik Buterin Proposes FOCIL to Strengthen Ethereum's Decentralization

Ethereum co-founder Vitalik Buterin has unveiled a three-pronged strategy to combat centralization pressures on the network. The proposal, outlined in an August 22 social media post, focuses on enhancing public mempool functionality, developing distributed block-construction systems, and establishing fallback channels for transaction inclusion.

Central to the plan is Fork-Choice Enforced Inclusion Lists (FOCIL), a novel mechanism that expands validator participation. "Instead of choosing one proposer per slot, we choose 17 proposers per slot," Buterin explained, noting one participant WOULD retain final transaction ordering privileges while sixteen auxiliary proposers guarantee transaction inclusion without full block production responsibilities.

The design potentially extends to smart contract wallets and privacy protocols, aiming to disrupt the emerging block builder oligopoly. Buterin emphasized these measures would prevent small validator groups from exercising undue influence over on-chain transaction flow.

Ethereum Price Projection Soars to $20,000 Amid Fed's Dovish Shift

BitMEX co-founder Arthur Hayes predicts Ethereum could surge to $20,000, fueled by bullish market dynamics and a softening stance from Federal Reserve Chair Jerome Powell. The cryptocurrency recently confirmed support at $4,109, with analysts eyeing new all-time highs NEAR $5,706.

Hayes dismisses the need for Ethereum to retest lower levels, citing its previous rally above $4,000 as a sign of strength. "Once Ethereum clears its prior peak, the path upward would resemble a gap of air," he noted, emphasizing limited resistance at higher valuations.

The forecast aligns with broader market Optimism as Powell hints at potential rate cuts, creating favorable macro conditions for risk assets. Hayes has already re-entered the market, buying back Ethereum after taking profits during its earlier ascent.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity with measured risk. The cryptocurrency is trading above key technical levels with strong momentum indicators suggesting potential upward movement toward $5,400.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $4,772.25 | Bullish |

| 20-Day MA | $4,325.14 | Support Level |

| MACD Histogram | +10.86 | Positive Momentum |

| Bollinger Upper Band | $5,002.01 | Near-term Resistance |

BTCC financial analyst Emma suggests that while short-term volatility may occur due to leveraged positions and ETF outflows, the long-term outlook remains positive given Ethereum's fundamental strengths and potential regulatory tailwinds.